For sole traders, superannuation is an important savings tool designed to help you secure your financial future after you stop working. Known as “super,” this system allows you to make voluntary contributions into super funds throughout your working life. These contributions are invested to grow over time, providing you with a financial cushion when you retire.

Understanding how super works can help you take control of your financial future and enjoy a more comfortable retirement.

Super for Sole Traders and Partnerships

If you’re a sole trader or part of a partnership, you don’t have to pay super for yourself, there’s no legal requirement for sole traders to contribute to superannuation but we highly recommend considering it. Making voluntary contributions can be a smart way to build your retirement savings and score some tax benefits too!

Here’s how you can make voluntary contributions:

![]() Personal Contributions: You can add money to a super fund of your choice. The ATO lets you deduct these contributions from your tax, up to a cap of $27,500 for the 2023-24 financial year. It’s a great way to lower your taxable income!

Personal Contributions: You can add money to a super fund of your choice. The ATO lets you deduct these contributions from your tax, up to a cap of $27,500 for the 2023-24 financial year. It’s a great way to lower your taxable income!

![]() Non-Concessional Contributions: These come from your after-tax income and aren’t taxed in your super fund. Just keep in mind they count towards the non-concessional cap, which is $110,000 a year.

Non-Concessional Contributions: These come from your after-tax income and aren’t taxed in your super fund. Just keep in mind they count towards the non-concessional cap, which is $110,000 a year.

Think of contributing to your super like giving future-you a little present. It could also help you rely less on government support in retirement.

Smart Superannuation Strategies for You

a. Maximise Your Tax Deductions

As a sole trader, contributions you make to your super can be tax-deductible, up to the contribution cap. This means you can lower your taxable income, which can make tax time a bit easier and potentially save you money on your tax bill.

b. Personal Concessional Contributions

As a sole trader, you can boost your super savings by making personal concessional contributions from your pre-tax income. This means you can contribute part of your earnings into your super fund, which helps reduce your taxable income. Just be sure to keep an eye on the contribution cap of $27,500 per year to avoid any excess contributions.

c. Spouse Contributions

If your spouse earns less than $40,000, you can contribute to their super and might even qualify for a tax offset of up to $540 for doing so!

d. Government Co-Contributions

If you’re a low-income earner (earning up to $58,445 in the 2023-24 financial year), the government may contribute up to $500 to your super when you make after-tax contributions. This is a fantastic way to boost your super savings without additional cost to you.

Important Deadlines You Can’t Miss

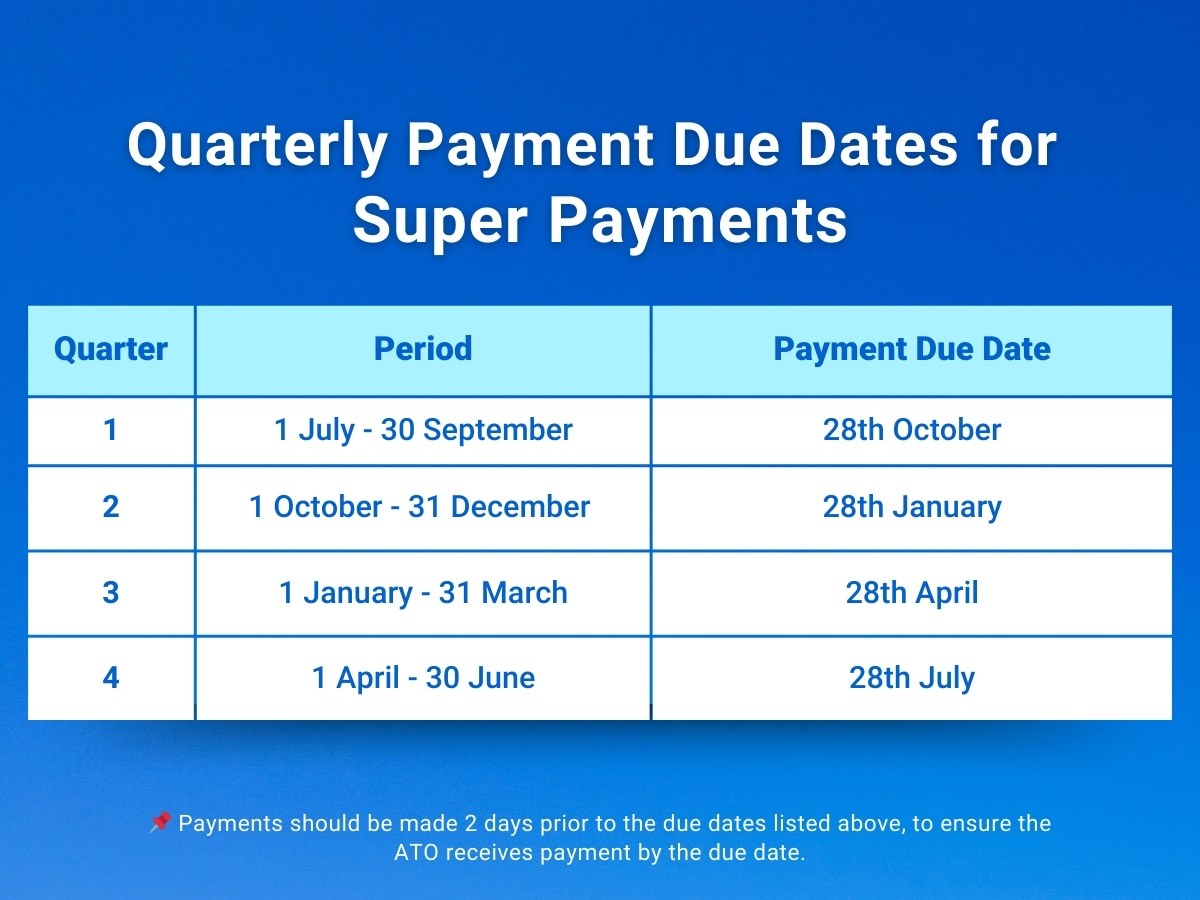

Super contributions need to be paid quarterly. If you miss these deadlines, you could face penalties from the ATO, which can include the Superannuation Guarantee Charge (SGC)—yikes!

Here’s when you need to have them in:

Key Takeaways

As a small business owner, getting to grips with superannuation is vital. It’s a smart move for your own financial future.

![]() Know your obligations under the Superannuation Guarantee and make those payments on time.

Know your obligations under the Superannuation Guarantee and make those payments on time.

![]() Use tax-efficient strategies like voluntary contributions and salary sacrifice to boost your super balance.

Use tax-efficient strategies like voluntary contributions and salary sacrifice to boost your super balance.

![]() Stay on top of deadlines to avoid any penalties.

Stay on top of deadlines to avoid any penalties.

Final Thoughts on Superannuation for Sole Traders

Superannuation plays a crucial role in securing a comfortable retirement, especially for sole traders in Australia. While it can seem overwhelming at first, with the right planning, managing your super doesn’t have to be complicated. Taking control of your superannuation is an investment in your future financial security.

Everyone’s financial situation is unique, so if you’re feeling uncertain or need assistance with your superannuation obligations, reach out to a friendly accountant (that’s us!). We’re here to simplify the process, allowing you to focus on growing and running your business.

Legal Disclaimer: The information on this site is based on sources believed to be reliable; however, we do not guarantee its accuracy or completeness and accept no liability for any loss or damage arising from reliance on this information. Always consult a financial advisor to assess the suitability of any information or strategies mentioned here with respect to your specific situation.