If you’re a small business owner in Australia, understanding superannuation is super important. As a key part of Australia’s retirement system, superannuation helps employees save for their well-deserved golden years. It might seem like a lot to wrap your head around, but don’t worry! We’re here to break it down for you in a way that makes sense.

In this guide, we’ll explain the basics of superannuation for small business owners. You’ll learn about your obligations, contribution requirements, and how super affects your team, all in plain English.

What is Superannuation?

Superannuation is basically a savings plan set up by the government to ensure we all have enough dough when we retire. Commonly known as ‘Super‘, it involves regular contributions made into super funds throughout an individual’s working life. These funds get invested and grow over time, giving your team a financial cushion for retirement.

Your Responsibilities as an Employer

If you are a business owner with employees, you’ve got some legal obligations when it comes to superannuation. The Superannuation Guarantee (SG) requires you to contribute a minimum percentage of your employees’ earnings into their chosen super fund. For the 2023-24 financial year, that rate is 11% of their ordinary time earnings, gradually increasing to 12% by July 1, 2025

📌Here’s what you need to remember:

Paying Super Contributions: You’re required to pay super for any employee earning more than $450 a month (unless they’re under 18 and working under 30 hours a week). Just remember to pay it at least quarterly!

SuperStream Compliance: You’ll need to use the SuperStream system to send super payments. It’s just a way to make sure everything is sent electronically and in the right format—easy peasy!

Choice of Super Fund: Your employees usually get to choose their own super fund. Just give them a standard choice form, and if they don’t pick one, you’ll put their contributions into a default fund.

Who is Eligible for Super?

Super contributions are required for all employees who:

![]() Are 18 or older

Are 18 or older![]() Earn more than $450 in a calendar month, or

Earn more than $450 in a calendar month, or![]() Are under 18 and work more than 30 hours a week.

Are under 18 and work more than 30 hours a week.

And yes, you need to pay super regardless of whether your employees are full-time, part-time, or casual. Some contractors might also be entitled to super, depending on how they’re paid.

Smart Superannuation Strategies for You

a. Maximise Your Tax Deductions

Contributions to super are tax-deductible for your business, up to the cap. This can help lower your taxable income and make tax time a bit easier.

b. Salary Sacrificing

You can set up a salary sacrifice arrangement for yourself or your employees. This means directing part of your pre-tax salary into your super fund, reducing your taxable income while boosting your super savings. Just make sure your total contributions don’t go over the cap of $27,500 per year.

c. Spouse Contributions

If your spouse earns less than $40,000, you can contribute to their super and might even qualify for a tax offset of up to $540 for doing so!

d. Government Co-Contributions

If you’re a low-income earner (making up to $58,445 in the 2023-24 financial year), the government might kick in up to $500 when you make after-tax contributions to your super fund.

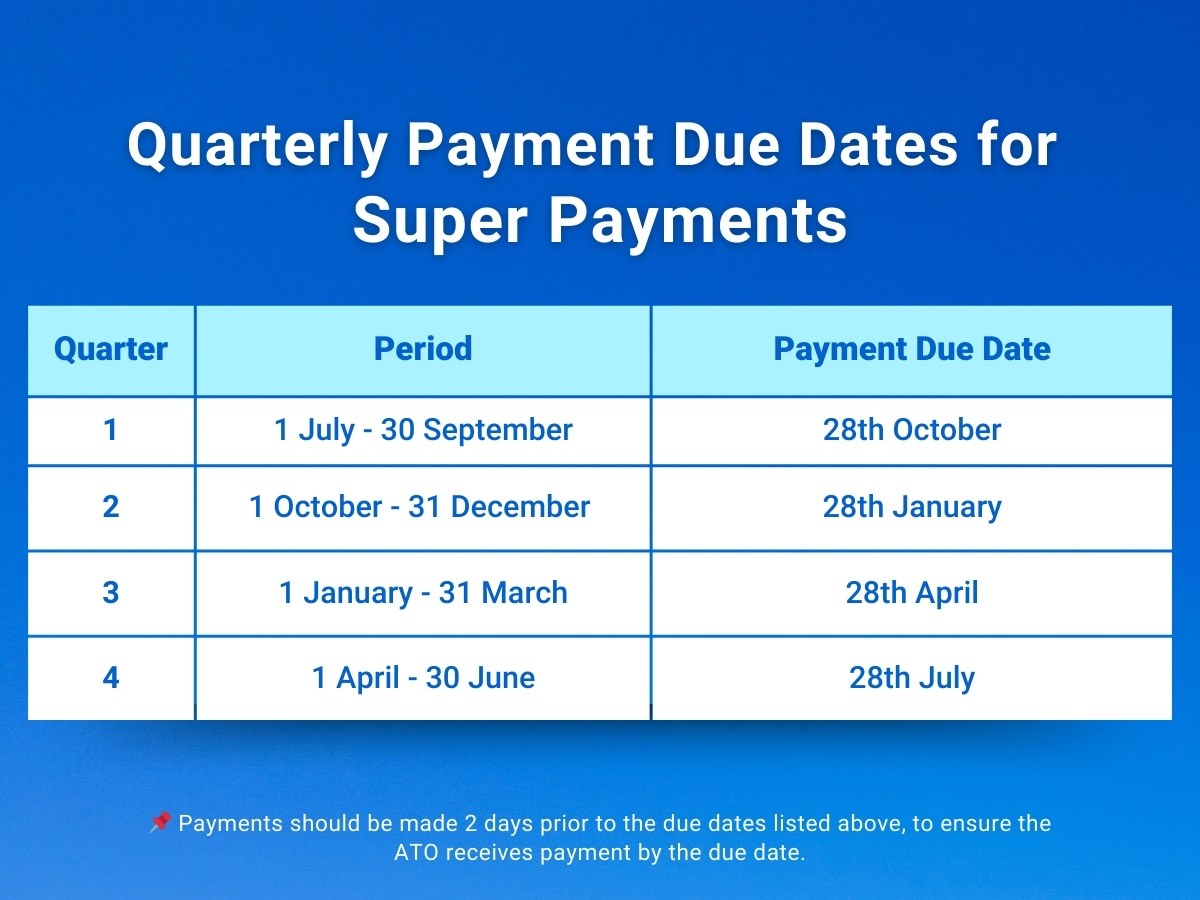

Important Deadlines You Can’t Miss

Super contributions need to be paid quarterly. If you miss these deadlines, you could face penalties from the ATO, which can include the Superannuation Guarantee Charge (SGC)—yikes!

Here’s when you need to have them in:

Getting Started with Super for Your Business

If you’re new to the world of superannuation, don’t sweat it! Here’s a simple checklist to help you get started:

![]() Choose a Default Fund: Pick a default super fund for employees who don’t choose their own. Make sure it’s MySuper-authorised to meet the necessary government standards.

Choose a Default Fund: Pick a default super fund for employees who don’t choose their own. Make sure it’s MySuper-authorised to meet the necessary government standards.

![]() Register for SuperStream: This is the system you’ll use to make super contributions. You can use payroll software, a super clearinghouse, or your super fund’s online payment system—whatever works for you!

Register for SuperStream: This is the system you’ll use to make super contributions. You can use payroll software, a super clearinghouse, or your super fund’s online payment system—whatever works for you!

![]() Keep Records: Make sure to keep records of all super payments for at least five years.

Keep Records: Make sure to keep records of all super payments for at least five years.

Key Takeaways

![]() Know your obligations under the Superannuation Guarantee and make those payments on time.

Know your obligations under the Superannuation Guarantee and make those payments on time.

![]() Use tax-efficient strategies like voluntary contributions and salary sacrifice to boost your super balance.

Use tax-efficient strategies like voluntary contributions and salary sacrifice to boost your super balance.

![]() Stay on top of deadlines to avoid any penalties.

Stay on top of deadlines to avoid any penalties.

Final Notes on Superannuation for Employers

Superannuation is a powerful tool to help your employees achieve a financially secure retirement. While it can seem like a lot to manage, a bit of planning and the right support can simplify the process.

If you’re feeling unsure or need guidance with your superannuation responsibilities, we’re here to help. Chat with a friendly accountant (yes, that’s us!) and let us take the stress out of super so you can focus on growing your business and levelling up your finances.

Legal Disclaimer: The information on this site is based on sources believed to be reliable; however, we do not guarantee its accuracy or completeness and accept no liability for any loss or damage arising from reliance on this information. Always consult a financial advisor to assess the suitability of any information or strategies mentioned here with respect to your specific situation.